Integrated Resort Scheme (IRS)

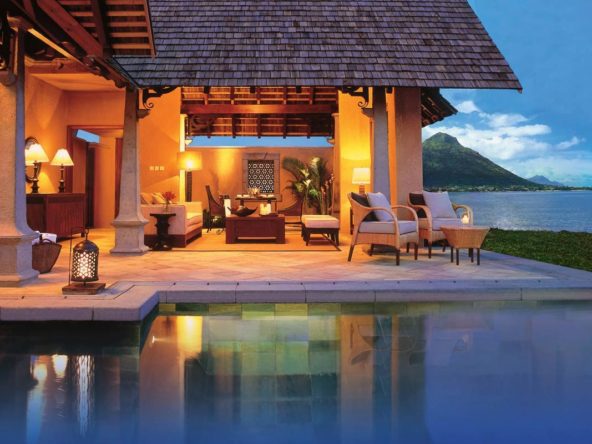

EDB – Info – These residential developments of luxury villas, sumptuous apartments and penthouses developed under the IRS offer a wide variety of world-class facilities for leisure, entertainment and wellness.

Some have golf courses, marinas, beach clubs, clubhouses and SPAs.

These activities and leisure activities are perfectly integrated in these prestigious residences and offer an exclusive resort experience.

These residences offer services such as:

- Rental Management

- Concierge services

- Restaurants

- Kids Club …

A foreigner can acquire residential properties such as villas, townhouses, penthouses, apartments, duplexes and serviced lots in existing IRS projects.

The non-citizen and his or her dependents can obtain a residence permit once he or she has acquired the property for a minimum amount of $375,000 USD.

Owners can rent the property, become tax residents in Mauritius and have no restrictions on the repatriation of funds or income from the sale or rental of the property.

Tax advantages will allow you to invest in the best conditions:

- No property tax

- No land tax

- No tax on the capital gain in case of resale

- No inheritance tax

- No wealth tax

- Double taxation treaties with many countries.

Non-citizens who have a residence permit under IRS will be exempted from an occupation or work permit to invest and work in Mauritius.

What can be acquired?

- Villas

- Townhouses

- Penthouses

- Apartments

- Duplexes

- Serviced plot of land (max extent of 1.25 A or 5,276 m2)

What are the IRS in Mauritius?

- Tamarina Golf Estate: West

- Anahita World Class Sanctuary: East

- Belle Riviere Estate: South

- Villa Valriche: South

- Club Med Villa: West

- La Balise Marina: West

- Matala Properties: West

- Monroze: West

- Le Parc de Mont Choisy: North

- Azuri: East

- 15 West: Central

- Anbalaba: South

Are you looking for a Villa or an Apartment to buy in one of these prestigious developments? Contact us

Villa (C) ZAMI: Luxury, Comfort, and Prestige in the Heart of Nature

- €840,000

- Beds: 4

- Baths: 3

- 343,08 m²

- Villa

Luxury Penthouse ZAMI: Absolute Elegance and Comfort

- €400,000

- Beds: 2

- Baths: 2

- 284,22 m²

- Villa

Villa (D) ZAMI: A Haven of Luxury and Serenity in a Natural Setting

- €930,000

- Beds: 5

- Baths: 4

- 401,91 m²

- Villa

New Project: 5 Modern Detached Houses for Sale

- €120,000

- Beds: 4

- Baths: 3

- 132 m²

- Town house

Villas La Vie Verte: Experience Elegance in the Heart of Nature

- €450,000

- €594,000

- Beds: 3

- Baths: 3

- 190,43 m²

- Villa

Exceptional Program: 9 Luxury Apartments with Penthouse and High-end Services

- €116,927

- €312,477

- Beds: 2-3

- Baths: 1-3

- 60,4 - 205 m²

- Apartment