What Factors Influence the Assessed Value of a Home in Mauritius?

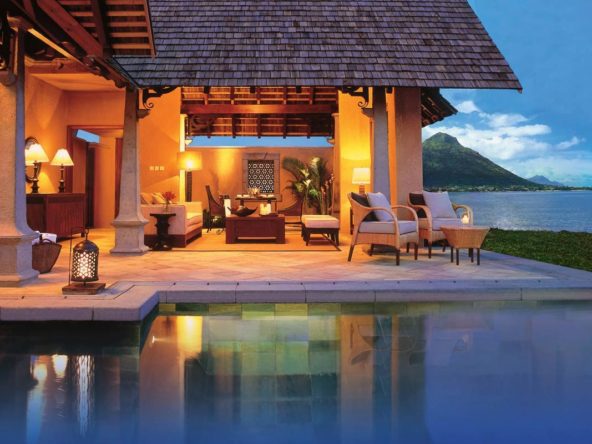

In Mauritius, the assessed value of a home is determined by a number of factors. These include the location of the property, its size, the condition of the building, the type of building materials used, the number of bedrooms and bathrooms, and the presence of any amenities such as a pool or garden. Other factors that can influence the assessed value of a home include the presence of security measures, the level of maintenance, and the availability of public transportation.

Location is a major factor in determining the assessed value of a home in Mauritius. Properties in prime locations, such as near the beach or in a popular residential area, are likely to have a higher assessed value than those in less desirable areas.

The size of a property is also considered when determining the assessed value. Generally, larger properties tend to have higher assessed values than smaller properties.

The condition of the building is very important in assessing its value. Buildings that are in good condition are more likely to be valued higher than those that are in disrepair.

The type of building materials used also affects the assessed value. Homes built with higher quality materials, such as brick or stone, tend to have a higher assessed value than those built with wood or other cheaper materials.

The number of bedrooms and bathrooms, as well as the presence of any amenities such as a pool or garden, can also influence the assessed value. Properties with more bedrooms and bathrooms, as well as those with amenities, tend to have higher assessed values.

The presence of security measures, such as gated communities, can also affect the assessed value of a home. Properties with security measures tend to be valued higher than those without.

Finally, the level of maintenance and availability of public transportation can also influence the assessed value of a home. Properties that are well maintained and have access to public transportation are likely to have higher assessed values than those that do not.

How to Understand the Difference between Assessed and Market Values for a Home in Mauritius?

When it comes to understanding the difference between assessed and market values for a home in Mauritius, it is important to take into account the different contexts in which these two values are used. Assessed value is the estimated value of a home based on factors such as the local real estate market, the condition of the home, and other factors. This value is used by the government to determine the amount of taxes that are owed on the home. Market value, on the other hand, is the amount that a buyer would be willing to pay for a home, considering all of its features and the current real estate market.

The assessed value of a home in Mauritius is determined by an assessor who takes into account the local real estate market, the condition of the home, and other factors. This value is typically lower than the market value of the home, as it does not take into account the potential of the property or any improvements that may have been made. In addition, the assessed value is usually based on the market value of similar properties in the area.

Market value, on the other hand, is determined by the current real estate market and the features of the home. This value is typically higher than the assessed value as it takes into account the potential of the property, any improvements that may have been made, and the current real estate market. Additionally, the market value is typically determined by comparing the home to similar properties in the area.

In conclusion, the assessed value of a home in Mauritius is based on factors such as the local real estate market, the condition of the home, and other factors, while market value is determined by the current real estate market and the features of the home. Both values are important to consider when looking at a home in Mauritius, but they should be used in different contexts.

What Are the Benefits of Knowing the Difference between Assessed and Market Values for a Home in Mauritius?

Knowing the difference between assessed and market values for a home in Mauritius can be beneficial for both home sellers and buyers. Assessed value is the value of a home as determined by the government for tax purposes. The market value is the amount that a buyer would be willing to pay for the home in the current market.

For Home Sellers

Knowing the assessed and market values of a home can help home sellers set a realistic price for their property. The assessed value is often lower than the market value and can be used to determine a realistic asking price for the property. Additionally, having a good understanding of the local market values can help home sellers create attractive pricing packages and negotiate better deals.

For Home Buyers

Home buyers can benefit from knowing the assessed and market values of a property. The assessed value can be used to determine if the asking price for the property is fair and in line with current market conditions. Additionally, buyers can use the assessed and market values to negotiate a better deal when making an offer on a property.

In conclusion, having an understanding of the assessed and market values of a property in Mauritius can be beneficial for both home sellers and buyers. Knowing the assessed and market values can help sellers set realistic prices and buyers make informed decisions when making an offer on a property.

What Are Some Common Misconceptions about Assessed and Market Values for a Home in Mauritius?

1. Misconception: Assessed and market values for a home in Mauritius are the same.

Reality: Assessed and market values are determined differently. Assessed value is the value of a property as determined by the government for taxation purposes, while the market value is the amount that a buyer is willing to pay for the property.

2. Misconception: Assessed and market values are static.

Reality: Assessed and market values can fluctuate over time depending on a variety of factors, including the condition of the property, the location, and the real estate market in the area.

3. Misconception: Assessed values are always lower than market values.

Reality: Assessed values are not always lower than market values, as they are determined by looking at the property’s condition and its location. In some cases, the assessed value can be higher than the market value.

How Can Homeowners in Mauritius Take Advantage of Knowing the Difference between Assessed and Market Values?

Mauritius homeowners can take advantage of knowing the difference between assessed and market values by using the information to their financial advantage. Assessed value, also known as the fair market value, is the value of a property for tax purposes, based on local property taxes. Market value is the estimated price a buyer would pay for a property in the current real estate market.

By understanding the difference between assessed and market values, homeowners can use the information to make informed decisions about their finances. For example, if the assessed value of a property is lower than the market value, the homeowner can take advantage of the lower tax assessment. This could save the homeowner money when filing their taxes.

On the other hand, if the assessed value of a property is higher than the market value, it could be an indicator that the local property taxes are too high. Understanding this could help the homeowner decide whether to appeal their property tax assessment or to look for another property with lower taxes.

In addition, understanding the difference between assessed and market values can help homeowners make informed decisions when it comes to selling or buying a property. Knowing the assessed value and the market value can give homeowners an idea of what their property is worth and what to expect when negotiating a sale or purchase.

In summary, understanding the difference between assessed and market values can be beneficial for Mauritius homeowners. By using the information to their advantage, homeowners can save money on their taxes and make informed decisions when it comes to buying or selling a property.

What Are the Implications of Knowing the Difference between Assessed and Market Values for a Home in Mauritius?

Knowing the difference between assessed and market values for a home in Mauritius can have important implications for any prospective homebuyers. Assessed values are typically determined by the local government for tax purposes and can be used to calculate property taxes. Market values, on the other hand, are determined by buyers and sellers in the real estate market and are based on the most recent sale prices of similar properties.

By understanding the difference between assessed and market values, prospective homeowners can gain valuable insight into the pricing of their home. Assessed values tend to be lower than market values, as they are based on historical data. This means that prospective homeowners may be able to purchase a home at a lower price than what it is worth in the real estate market. However, this could also mean that the prospective homeowner could end up paying more in property taxes than they would otherwise.

Another implication of knowing the difference between assessed and market values is that it can help prospective homeowners determine whether they are getting a good deal on a home. By comparing the assessed value to the market value, buyers can get a better understanding of whether they are paying a fair price for the home.

Finally, understanding the difference between assessed and market values can help prospective homeowners plan for their future. Knowing the assessed and market values of a home can help them determine how much their property taxes may increase in the future, and also help them plan for any necessary repairs or upgrades.

In summary, understanding the difference between assessed and market values for a home in Mauritius can have important implications for prospective homeowners. It can help them get a better understanding of the pricing of their home, determine whether they are getting a good deal, and plan for the future.

How Can Homeowners in Mauritius Use the Difference between Assessed and Market Values to Their Advantage?

Mauritius is a small island nation located in the Indian Ocean. Homeowners in Mauritius can use the difference between assessed and market values to their advantage when it comes to buying and selling real estate. The assessed value of a home is the value assigned to it by the government for tax purposes. The market value of a home is the actual value of the home based on the current market conditions. The difference between the assessed and market value of a home in Mauritius can be significant and can provide homeowners with an opportunity to save money.

If the assessed value of a home is lower than the market value, the homeowner can use this to their advantage when selling a home. The homeowner can list the home for the market value and the buyer will have to pay taxes based on the assessed value, which is considerably lower. This can be beneficial for both the buyer and seller, as the buyer will be able to purchase the home for a lower price and the seller will be able to make a larger profit.

On the other hand, if the assessed value of a home is higher than the market value, the homeowner can benefit when purchasing a home. The homeowner can negotiate with the seller to pay taxes based on the lower assessed value, which means they will be able to purchase the home for a lower price.

In summary, the difference between the assessed and market value of a home in Mauritius can be used to the advantage of both buyers and sellers. For sellers, they can list their home for the higher market value and the buyer will have to pay taxes based on the lower assessed value. For buyers, they can negotiate with the seller to pay taxes based on the lower assessed value, which will allow them to purchase the home for a lower price.

For more information please contact us: Click here